The Olympics is one of the most important broadcast sports events of this year, so why is it so hard for fans to stream it? Our latest research reveals how SportsVOD subscribers are being forced to sign up for a new or additional streaming service just to watch Paris 2024. It’s proof of how fractured the SportsVOD landscape has become – and a sure sign that things need to change.

In July 2024, the Paris Olympics is set to captivate millions of US viewers as the world’s biggest sporting competition returns to spectator-filled arenas after six years. The central European timezone means broadcast times will be better for American audiences, with a wider range of consumers ready to tune in to an unprecedented 329 medal events.

Research from our brand new guide shows that almost a third (29%) of US subscribers will sign up for a new sports video-on-demand (VOD) subscription to watch the 2024 Olympics, and two-thirds (66%) of those who currently pay for a SportsVOD membership are planning to sign up for an additional subscription service. It seems that while interest in the games is high — so is the price people have to pay for it.

The data is a clear indictment of the market fragmentation subscribers continue to have to put up with. Media companies and streaming services still cling to a traditional strategy of exclusive rights to drive subscriber acquisition and retention, even as the cost of acquiring them continues to rise. Yes, sports broadcasting rights remain extremely lucrative. But perhaps we should be asking: ‘For how much longer?’

SportsVOD subscribers are tapping out

With so many providers securing exclusive rights to certain sports or events, sports fans often need multiple subscriptions to access all the content they love. Our findings reveal that the average number of subscriptions US consumers pay for is five. But for SportsVOD subscribers, that increases to seven.

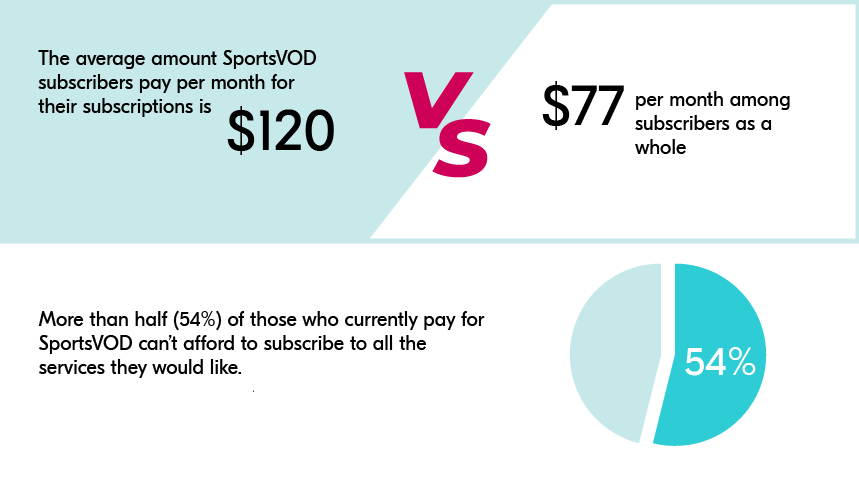

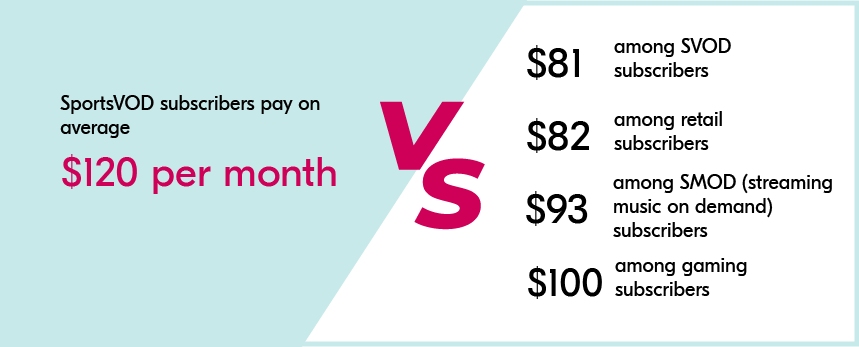

Data from SportsVOD — Setting new records reveals the financial burden this generates for subscribers.

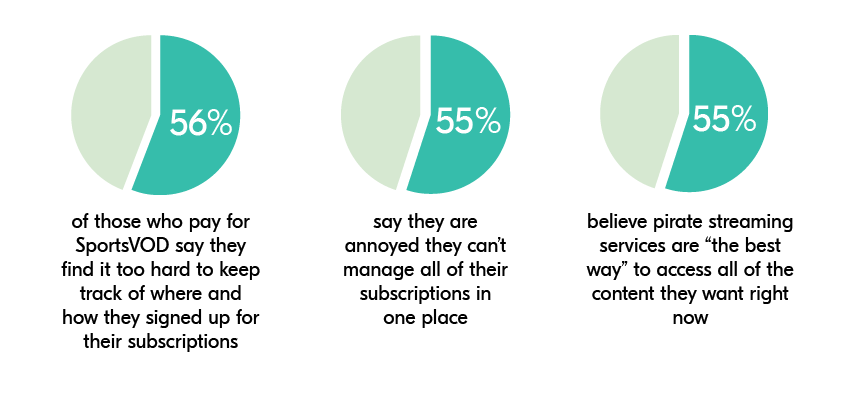

And it’s not just the economic cost. Managing multiple subscriptions and navigating through different platforms can create a frustrating experience for users.

Increasingly, SportsVOD subscribers are channelling that frustration into finding their own means of accessing content via piracy. Illegal streaming poses a significant risk to content providers who, along with their advertisers, could face substantial revenue losses as a result.

We need a new defense strategy

All of this hasn’t gone unnoticed by media players like ESPN, Fox, and WB Discovery who have recently banded together to form their so-called ‘Spulu’ sports streaming service. The service will encompass live content from the NFL, NBA, PGA Tour, Grand Slam Tennis, NASCAR, and more under one streaming roof.

But this new joint venture is not the panacea subscribers are hoping for. Issues around fair market competition, in-fighting between brands, and too many cooks mean it is unlikely that this will be the new affordable ‘home’ for sports streaming.

And sports fans don’t even want that.

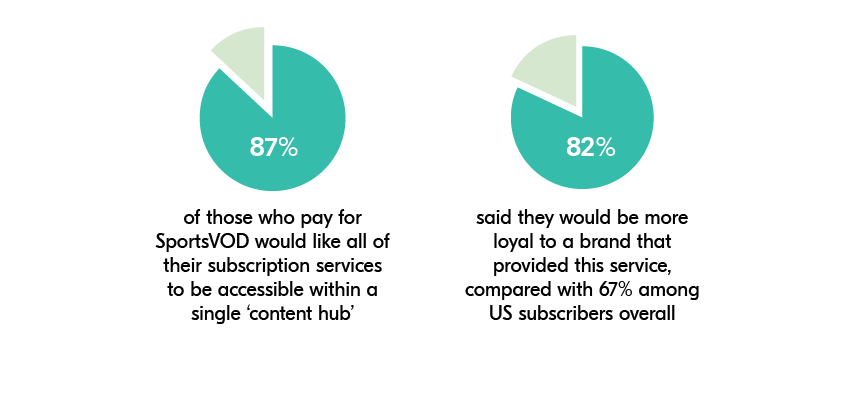

What they want is choice. They are willing to pay to watch the content they are interested in, and the reality is that this content will come from different providers. As a result, sports fans want to simplify this arrangement through easy billing and control of subscriptions. And they want flexibility and the ability to build their own bundles.

This is where Super Bundling can provide the best solution for everyone.

Super Bundling simplifies the decision-making process for sports fans by offering a comprehensive package that reduces the need for multiple subscriptions and consolidates billing and login information into a single account.

By combining several services into one package, SportsVOD providers can offer these bundles at a lower price than the total cost of individual subscriptions. At the same time, the perceived value of what they’re providing goes up as consumers get access to diverse content and feel they’re getting more for their money.

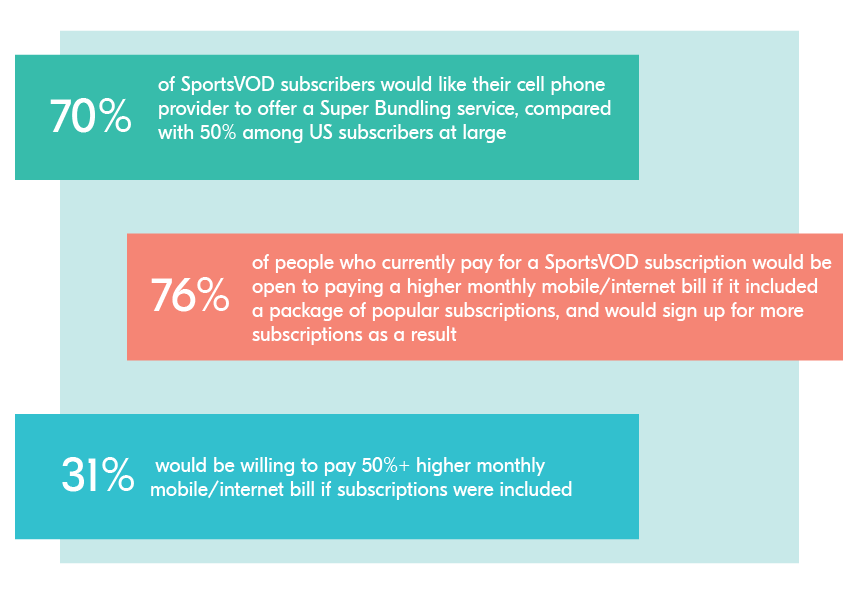

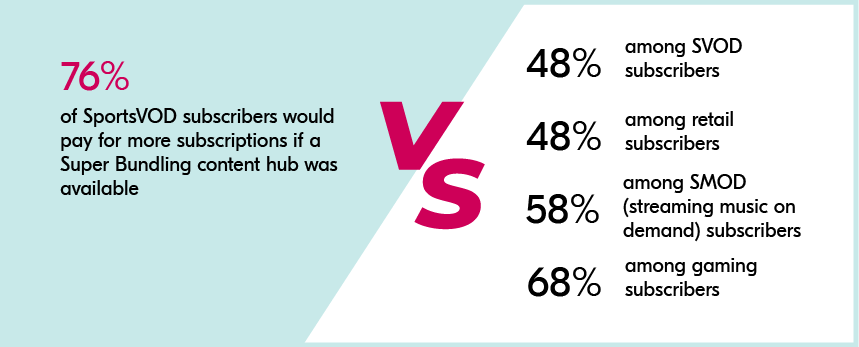

Our data demonstrates just how much SportsVOD subscribers are keen for a Super Bundling solution.

Why telcos should join the team

Telcos are uniquely positioned to play a significant role in the SportsVOD Super Bundling future. Their involvement can catalyze the distribution of bundled services, leveraging their existing robust networks and infrastructure, large customer bases, and billing relationships, as well as technical capabilities to improve streaming quality during high-traffic events.

Super Bundling is a win-win for sports streaming subscribers, content providers and telcos, opening up limitless possibilities for dynamic deals, robust growth, and thrilling new experiences for sports fans everywhere.

SportsVOD subscribers: The A-Team

If Super Bundling is the winning tactic in the game of subscriber attraction and retention, then Super Bundling for SportsVOD subscribers is how telcos can ensure they stay top of the table long-term.

Why? Because the data reveals that SportsVOD subscribers return the highest potential value for providers overall. They subscribe to more services – 7 on average compared to 5 or 6 for other subscribers.

And as a result, they spend more money.

SportsVOD subscribers are also more willing to spend even more money through a Super Bundling content hub.

The SportsVOD subscriber represents the most premium player in the Super Bundling bidding wars. If there was any doubt, this fact alone is enough reason for telcos to capitalize on this cohort’s unique potential for revenue generation, by focusing their efforts in the SportsVOD arena.