The subscription economy has reached a watershed moment.

With European airline Wizz Air recently announcing its “all-you-can-fly service,” it seems it won’t be long until every consumer product is available by subscription. Worldwide the industry is worth around $3 trillion – higher than most countries’ economies. It’s a figure that is only projected to grow as more customers demand that their products and services be delivered this way.

But companies cannot afford to rely on the popularity of the subscription model alone. 2024 is a watershed moment for the subscription economy as consumer behavior shifts to a place where convenience, personalization, and added value are expected as standard.

As competition – and financial constraints – intensify, subscription providers must innovate beyond content quality and direct sign-ups to attract and retain customers. Super Bundling is emerging as a significant trend, with a growing body of research establishing it as a critical strategy in the year to come.

Bango has been at the forefront of research into the Super Bundling space since 2022. Our latest report – Super Bundling: Global trends – gathers together research into the attitudes and behavior of 16,400 subscribers conducted across Europe, Latin America, and the USA.

In it, we uncover ten key trends defining the evolving subscription economy and the vital insights for organizations that emerge. Below are some of the highlights.

For the complete and in-depth list of all the trends, download our report.

- Subscribers are frustrated with the standard subscription model

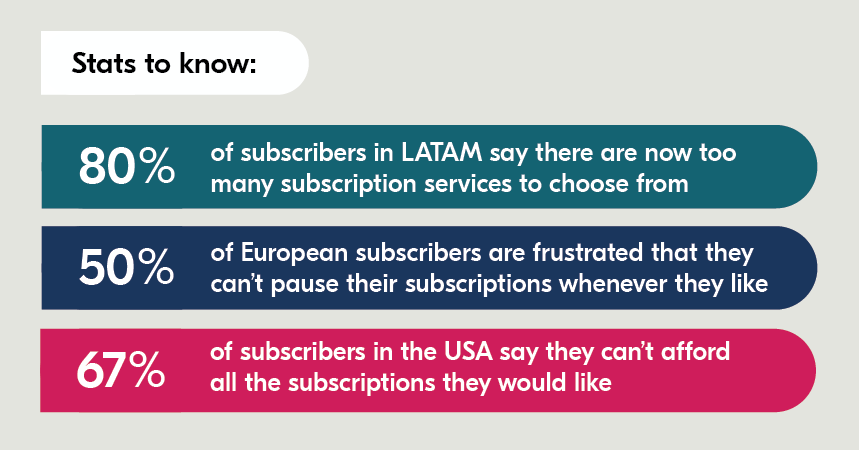

While all signs point to continuing growth for the subscription economy, cracks are starting to appear. Subscribers across the three regions surveyed are increasingly overwhelmed by a mounting pile of subscriptions – made worse by the lack of flexibility when it comes to managing them.

Recent price hikes and crackdowns on password sharing have added to the pressure, leading to further frustrations. In fact, our research shows that subscribers globally have likely reached a price ceiling and would not be receptive to further increases. For example, the average American subscriber already pays $924 per year on subscriptions, meaning a model of rising prices may not be sustainable in the long term.

- “Vampire subscriptions” are on the rise

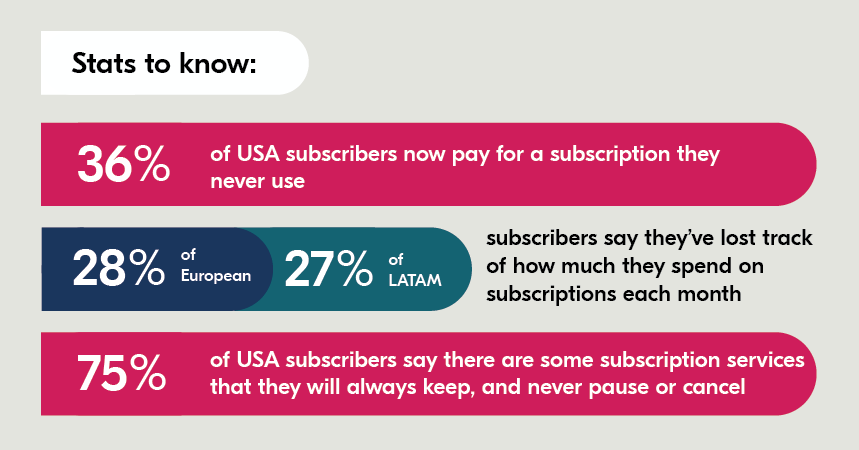

Almost half of American subscribers (44%) struggle to keep track of where and how they signed up for services, leading to the emergence of “vampire subscriptions” – those long-forgotten subscriptions that suck money out of consumers’ bank accounts.

“Vampire subscriptions” are tormenting subscribers everywhere as they struggle to stay on top of what they’ve signed up for. All the while the renewals keep rolling. It’s a trend exacerbated by the fact that purchasing a sub is typically much easier than canceling it.

On the other side of the coin, “forever subscriptions” are proving that subscribers are ready and willing to commit to the right package – with a majority in all three regions promising they will never cancel their favorite subscriptions. This represents a huge prize to subscriptions that can break into that club.

- Password-sharing crackdowns have been successful – to a point

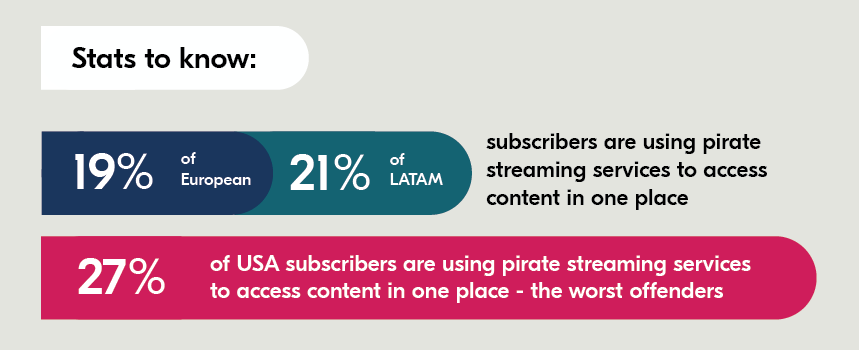

Netflix started a trend in 2023 when its crackdown on password sharing went into effect. Other subscription providers quickly followed suit, bolstered by the streaming giant’s uptick in subscriber numbers and retention as a result of its tough new stance. And it continues with HBO Max recently announcing it would be offering the option to pay for non-account holders in an effort to curb password sharing later this year.

Many users who were previously sharing accounts are now opting to pay for their own subscriptions. But there are also many who are either canceling subscriptions or turning to alternatives – like pirate streaming platforms – as a consequence.

- Tiered subscriptions are unlocking new growth

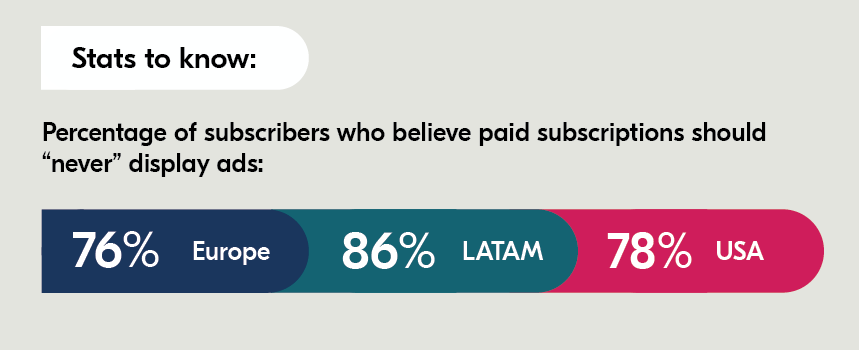

A relatively recent introduction to the market, it looks like tiered subscriptions are here to stay. Lower cost or free tiers supported by ads are making premium content accessible to a broader audience – including those impacted by the recent price rises and password-sharing crackdowns.

Ad-tiering is a model that appeals in particular to budget-conscious consumers willing to watch ads in exchange for reduced fees. However, the addition of advertisements brings with it the risk of a poorer user experience where there are too many ads, or the ads are too invasive or disruptive.

This inevitably leads to customer dissatisfaction and higher churn rates – undermining the aim of ad-tiering in the first place. There’s a strongly held belief among subscribers that advertising doesn’t belong in the world of subscriptions.

Mobile price-tiering is a much more user-friendly alternative that has taken off in LATAM where many customers access their subscriptions – especially streaming services – via mobile. Paramount+ has a mobile-specific plan that offers content optimized for small screens and varying data consumption needs.

- Indirect subscriptions are popular in Europe

Frustrated with the subscription status quo, subscribers are hunting around for the best possible deals, ready to drop one provider in favor of another with a better plan. As a result, indirect subscriptions – where customers sign up through a telco rather than the subscription provider itself – have become a major market with combined content plans, unique bundles, and third-party selling all proving lucrative channels of growth.

The potential of bundling strategies is clear. Consumers are demonstrating their desire for bundled packages, with offerings from telcos bundling mobile, internet, TV, and streaming taking off – and establishing telcos as a rising force in the subscription economy.

- Content hubs powered by Super Bundling will set the new standard

Consumers are crying out for a Super Bundling platform to solve their subscription woes. Essential features they want include the ability to: pay multiple subscriptions via one monthly bill, temporarily pause subscriptions, update payment details on one platform, and access content all in one place.

Full-service content hubs in the USA (Verizon +play) and Australia (Optus SubHub) have made waves in their regional markets with their consumer-first convenience. Subscribers are now calling out for these types of all-in-one platforms to break into Europe and LATAM.

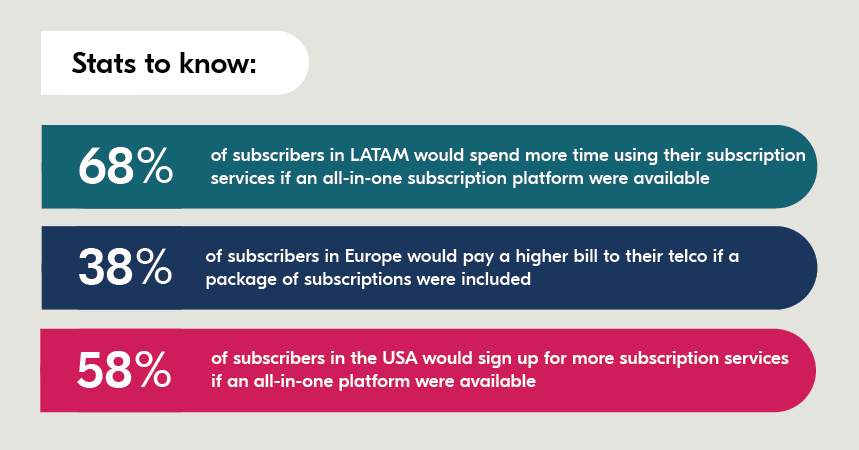

The potential for content hubs to increase retention and decrease churn is loud and clear – subscribers say that if a content hub were available they would likely spend more time on it and sign up for more services. A significant number would also be willing to pay more to the telco that could offer it.

To learn more about these and the other key trends impacting the subscription economy in the USA, LATAM, and European markets, download our report ‘Subscription Wars: Super Bundling – Global trends‘.